How to Choose a Reliable Insurance Agent List Provider (And the Red Flags to Avoid)

If you market to licensed insurance agents, the list you buy determines your results. The right provider delivers clean, compliant, and current data that converts. The wrong provider burns your domain, wastes budget, and creates compliance risk. This guide explains how to choose a reliable insurance agent list provider, what to verify before you buy, and the red flags to avoid.

We’ll cover practical checks you can run in under 10 minutes, the metrics that matter, and how to test a provider without overcommitting. Use this as your due diligence checklist before your next campaign.

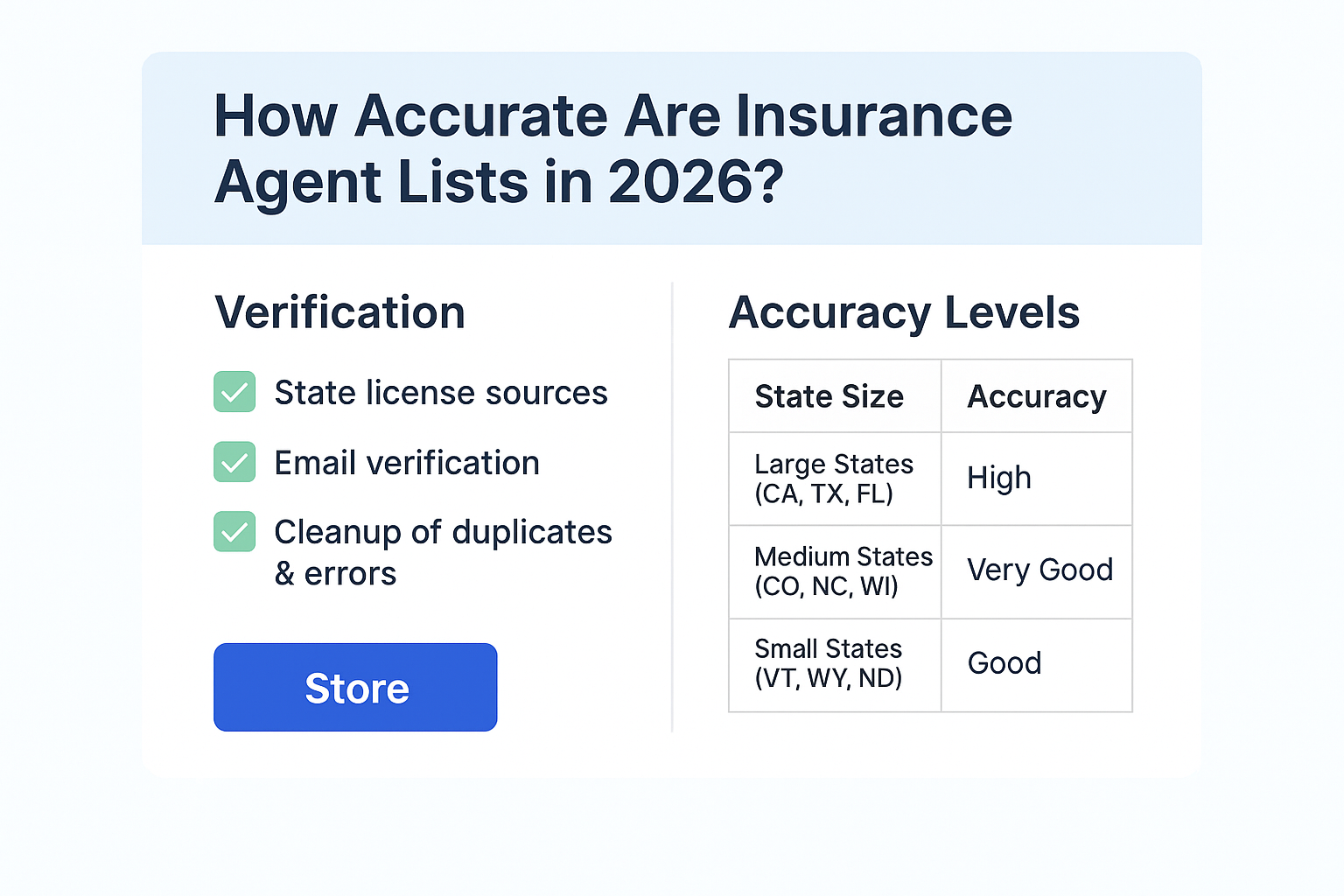

What “Reliable” Means for an Insurance Agent List

Reliable is not a slogan. It’s measurable. A high‑quality insurance agent list should show:

- Transparent sourcing. Clear explanation of how the data is collected (e.g., state licensing files, verified B2B signals). If you want a deeper overview of standard fields and sources, see what’s typically included here: https://www.insuranceagentlists.com/whats-included-in-an-insurance-agent-list-in-2026

- Recency. Update cycles of 30–90 days for core contact fields. License status refreshed on a consistent cadence.

- Multi-point verification. Email hygiene, phone validation, and license status checks. Not just a one-time web scrape.

- Deliverability history. Expected hard bounce rates under 3–5% on hygiened segments, when mailed correctly.

- Coverage depth. Both lines of authority (P&C, Life & Health), carrier appointments where available, location, firmographics, and role data (owner, producer, CSR).

- Compliance readiness. Clear usage rights, opt-out handling for email, DNC support for telemarketing, and guidance for lawful outreach. This article breaks down the realities of data accuracy in the current cycle: https://www.insuranceagentlists.com/what-does-accurate-data-really-mean-in-2026

- Testable samples. Real samples you can validate before purchase. Request one here: https://www.insuranceagentlists.com/sample

Quick Vetting: How to Assess a Provider in 10 Minutes

Use these steps before you pay:

-

Ask where the data comes from

- Look for state licensing sources, normalized and verified. If you’re new to locating licensed agents by state, this guide helps: https://www.insuranceagentlists.com/how-to-find-licensed-insurance-agents-in-any-state-2026-guide

-

Check counts and coverage by state

- Confirm that counts align with reality. A quick reference point is here: https://www.insuranceagentlists.com/state-counts

- If a provider’s counts are inflated, expect higher bounces and wasted dials.

-

Review what fields are included

- Ensure you get the fields your strategy needs (emails, phones, lines of authority, location, company, role). A field checklist is outlined here: https://www.insuranceagentlists.com/whats-included-in-an-insurance-agent-list-in-2026

-

Request a sample and test it

- Validate email format, dedupes, and role accuracy. Ask for a sample at: https://www.insuranceagentlists.com/sample

-

Verify update cadence and hygiene

- Ask when core fields were last updated. Email hygiene should be routine. License statuses should be refreshed on a predictable schedule.

-

Ask for expected performance ranges

- If you deploy properly, what bounce rates should you expect? What phone connect rates? A credible provider can give directional ranges, not guarantees.

-

Confirm usage rights and compliance guidance

- Make sure you understand permitted use (email, phone, SMS, voice). For channel-specific guidance, review:

- Email outreach: https://www.insuranceagentlists.com/email-marketing

- Voice broadcast considerations: https://www.insuranceagentlists.com/voice-broadcast

- LinkedIn outreach: https://www.insuranceagentlists.com/linkedin-marketing

-

Evaluate responsiveness

- Send a few specific questions. Note how quickly and precisely they answer. Vague responses are a warning sign.

The Top Red Flags to Avoid

Watch for these issues. They correlate with high bounce rates, low response, and compliance exposure.

- “Unlimited downloads” or “lifetime access.” Good data decays. Quality vendors fund continuous updates and don’t give away the farm.

- One price for “the entire USA” with no segmentation. Professionals maintain value by segment, line, and state.

- Claims of “all opt-in” licensed professionals without context. Licensed agent data is not “opt-in” by default. Email compliance depends on lawful basis and opt-out handling, not blanket “opt-in” claims.

- No sample, or only a screenshot. If they can’t provide a real sample, walk away.

- No update schedule. If they won’t say when they last updated, assume the worst.

- “Scraped from LinkedIn only.” Social signals are sometimes useful but insufficient for license verification and scale.

- Personal email domains for sales/support (e.g., Gmail). Use caution.

- Inflated counts (“millions of agents”). Check against realistic state totals: https://www.insuranceagentlists.com/state-counts

- No replacement policy for obvious hard bounces in a short window. This suggests limited confidence in their data hygiene.

- Prices far below market, especially with big promises. There’s always a cost to quality, verification, and compliance.

Comparison: Types of Insurance Agent List Providers

Use this table to understand the tradeoffs you’ll encounter in the market.

| Criterion | State-Sourced Specialist | Marketplace/Reseller | Offshore Web Scraper | What to Ask |

|---|---|---|---|---|

| Source transparency | High (states + verification) | Varies by seller | Low | “Which state sources? How often updated?” |

| Update cadence | 30–90 days typical | Inconsistent | Unknown | “Last refresh date for email/phone/license?” |

| Deliverability | 95–97%+ valid emails when deployed correctly | Varies widely | Poor | “Typical hard bounce range on recent sends?” |

| License accuracy | High | Medium | Low | “How is license status validated?” |

| Coverage depth | Strong by line/state | Mixed | Shallow | “Which fields are included?” |

| Compliance guidance | Clear | Mixed | None | “What usage rights and opt-out guidance apply?” |

| Pricing | Fair, tied to value | Varies | Very low | “What’s the replacement policy for early bounces?” |

What a Data Quality Chart Would Show

Imagine a bar chart titled “Hard Bounce Rate by Provider Type (30-Day Window).” Bars display average hard bounce rates from pilot sends:

- State-sourced specialist: 2.1%

- Marketplace/reseller: 6.7%

- Offshore scraper: 14.3%

You would also see error bars reflecting variance by deployment quality. A trendline would indicate that lists updated within 60 days correlate with sub-3% hard bounces, while lists older than 180 days spike past 8–10%. The chart underscores two points: source quality and recency matter; your deployment (warmup, throttling, authentication) still impacts results.

Data Quality Metrics That Matter

Ask for these metrics and align them to your campaign goals:

- Hard bounce rate. Aim for under 3–5% on a fresh, hygiened segment deployed from a warmed domain.

- Valid vs. risky emails. Percent of deliverable addresses after hygiene.

- Phone connect rate. Depends on specialty; for producers, 8–15% connect on targeted dial blocks is typical when phones are verified and call windows are respected.

- License verification rate. Percentage of records with validated, current license and line(s) of authority.

- Deduplication. Suppression across carriers, agencies, and your existing CRM to avoid waste.

- Address accuracy (for mailers). CASS/NCOA processing if you do direct mail.

- Update age distribution. Share of records updated in the last 30, 60, 90, 180 days.

Two Real-World Scenarios (and What We Learned)

Scenario 1: National life carrier recruiting

- Goal: Book interviews with experienced Life & Health producers in five target states.

- List A (cheap marketplace): 7.9% hard bounces, 0.18% reply rate, high “not a producer” replies.

- List B (state-sourced specialist): 2.3% hard bounces, 0.92% reply rate, 3.1% meeting rate.

Takeaway: Accurate line-of-authority fields and recent updates drove a 5x higher reply rate and cleaner pipeline. Want to understand L&H coverage options? Review: https://www.insuranceagentlists.com/Life-and-Health

Scenario 2: MGA cross-sell to P&C independent agencies

- Goal: Quote personal lines with agencies writing small commercial.

- List A (scraped web): Many general agency emails, minimal producer contact data. 12% hard bounces, almost no booked calls.

- List B (verified P&C agents): 2.6% hard bounces, 1.4% meeting rate from a multi-touch sequence (email + warm dials + LinkedIn follow). For P&C segmentation details, see: https://www.insuranceagentlists.com/Property-and-Casualty-Agents

Compliance Checklist for Agent Outreach

-

Email

- Authenticate sending domains (SPF, DKIM, DMARC). Honor opt-outs immediately.

- Provide a working physical address and a one-click unsubscribe. See channel guidance: https://www.insuranceagentlists.com/email-marketing

-

Phone and voice

- Respect federal and state Do Not Call rules and exemptions. Get express consent for automated dialing and prerecorded messages where required. Review broadcast considerations: https://www.insuranceagentlists.com/voice-broadcast

-

SMS

- Obtain explicit consent. Provide clear opt-out language.

-

Privacy

- Maintain suppression files, document lawful basis for processing, and respond to opt-out/rights requests promptly. If you need to reference consumer choice, see: https://www.insuranceagentlists.com/do-not-sell-my-personal-information

How to Pilot a Provider Before You Commit

Run a contained test that mirrors your real program:

-

Define the segment

- Pick one line (e.g., P&C producers) in 1–3 states and one goal (appointments or applications).

-

Request a sample and verify

- Validate emails and phones on your side. Confirm lines of authority and roles. Request a sample at: https://www.insuranceagentlists.com/sample

-

Warm and authenticate

- Send from a warmed domain with SPF/DKIM/DMARC. Throttle sends and avoid blast behavior on day one.

-

Track the right KPIs

- Hard bounces under 3–5% on the first wave. Positive reply rate above 0.6–1.0% for targeted recruiting or B2B sales is a healthy benchmark, with proper messaging.

-

Add a call layer

- Use compliant calling to qualified prospects from the email wave. Measure connect rate and booked meetings.

-

Expand deliberately

- Scale the same targeting to adjacent states or lines once you validate performance. Reference realistic market coverage using state-level views where helpful, such as: https://www.insuranceagentlists.com/state-insurance-departments/Florida

Where to Source Agent Lists by Line and State

If you need turnkey coverage by line of authority or the entire country, these resources will help you map demand to inventory:

- Life & Health agent lists (category): https://www.insuranceagentlists.com/store/Life-&-Health-Insurance-Agent-Lists-c140161591

- Property & Casualty agent lists (category): https://www.insuranceagentlists.com/store/Property-&-Casualty-Insurance-Agent-Lists-c140161592

- Entire USA Life & Health list: https://www.insuranceagentlists.com/store/50-States-Life-&-Health-Insurance-Agent-List-p235441264

- Entire USA P&C database: https://www.insuranceagentlists.com/store/50-States-P&C-Database-p416764524

- For programmatic buyer enablement or specific carrier-aligned segments, browse all store options: https://www.insuranceagentlists.com/store

Due Diligence Questions (Copy/Paste)

Send these to any provider you’re considering:

- Which state licensing sources do you use? How often do you refresh email, phone, and license fields?

- What is your expected hard bounce rate range on fresh segments when deployed from a warmed, authenticated domain?

- What fields are included by default? Can I filter by line of authority, carrier appointment, state, and role?

- Will you provide a testable sample and a short replacement window for obvious early hard bounces?

- What usage rights apply to email, phone, SMS, and voice outreach? Do you provide guidance for opt-outs and DNC?

- How do your counts compare to public totals? (I’ll cross-check here: https://www.insuranceagentlists.com/state-counts )

- What support do you offer during the first 30 days?

Outreach Strategy: Make Your Data Work Harder

Good data does not guarantee results. Pair it with a disciplined outreach plan:

-

Multi-channel touch pattern

- Email (value-first, short copy, single CTA)

- Compliant warm calls to opens/clicks

- LinkedIn visits/connection where appropriate: https://www.insuranceagentlists.com/linkedin-marketing

-

Tight targeting

- Align message to line of authority and state regulation.

-

Iteration

- Test subject lines, offers, and send windows. Keep what works. Cut what doesn’t.

Why Recency Beats Raw Volume (And What Decay Looks Like)

Contact data decays fast. Producers change agencies. Emails deprecate. Phone routing changes. In practice:

- Within 90 days, you can maintain sub-3% hard bounces with a quality, hygiened list and good sending practices.

- Between 90–180 days without refresh, bounces and connect difficulty climb.

- Beyond 180 days, expect sharp declines in response unless the provider performs ongoing verification.

A simple line chart titled “Deliverability Over Time Without Refresh” would show a gradual decline from 97–98% deliverability in the first month to ~92–94% by month six, then accelerating downward. The operational lesson: buy from providers who refresh frequently, and execute campaigns promptly.

Common Buying Mistakes (And How to Avoid Them)

- Buying “everything” before testing. Start small, validate, then scale.

- Ignoring fields that drive routing. Role and line of authority matter. Do not target “all agency emails” if you need producers.

- Skipping email authentication. A good list sent from a bad setup will still perform poorly.

- Single-channel outreach. Add compliant calling and LinkedIn to lift meetings.

- Not aligning states to your offer. Regulations and carrier distribution vary by state. See a state-level licensing view for planning, e.g., Florida: https://www.insuranceagentlists.com/state-insurance-departments/Florida

What to Expect When You Buy Right

When you choose a specialist provider and deploy well:

- Clean deliverability. Hard bounces typically in the 2–4% range on first sends.

- Higher reply and meeting rates. Relevance from accurate line and role data drives responses.

- Lower compliance risk. Clear usage rights, prompt opt-out handling, and DNC awareness.

- Faster ramp. Less time cleaning data. More time in conversations.

When you buy wrong:

- Double-digit bounce rates. Poor hygiene and staleness.

- Low response. Misaligned targeting and wrong contacts.

- Domain risk. Spam placement and reputation damage.

- Compliance exposure. No guidance or support, unclear permissions.

Next Steps

- See what’s included in a modern agent list: https://www.insuranceagentlists.com/whats-included-in-an-insurance-agent-list-in-2026

- Review national coverage options:

- Request a sample and test a focused segment: https://www.insuranceagentlists.com/sample

- If you want help selecting the right segment for your goal, contact us: https://www.insuranceagentlists.com/contact

Conclusion

Choosing the right insurance agent list provider is a data decision, not a leap of faith. Demand transparent sourcing, recent updates, measurable quality, and clear usage rights. Run a controlled pilot. Track the right metrics. Scale only after you validate results.

If you need a fast, reliable starting point, browse by line of authority here:

- Life & Health category: https://www.insuranceagentlists.com/store/Life-&-Health-Insurance-Agent-Lists-c140161591

- Property & Casualty category: https://www.insuranceagentlists.com/store/Property-&-Casualty-Insurance-Agent-Lists-c140161592

Or request a no-obligation sample and see the data for yourself: https://www.insuranceagentlists.com/sample