Where to Buy Verified Licensed Insurance Agent Lists by State

If you sell to producers or recruit agents, you need state-targeted lists you can trust. “Verified licensed” should mean the records match active licenses, contact channels are tested, and fields map cleanly into your CRM and outreach tools. In this guide, you’ll learn where to source licensed insurance agent lists by state, the tradeoffs between providers, and how to select the right file for your campaign. We’ll also show pricing benchmarks, sample scenarios, and the compliance checkpoints you should not skip.

What “Verified Licensed Insurance Agent Lists” Really Means

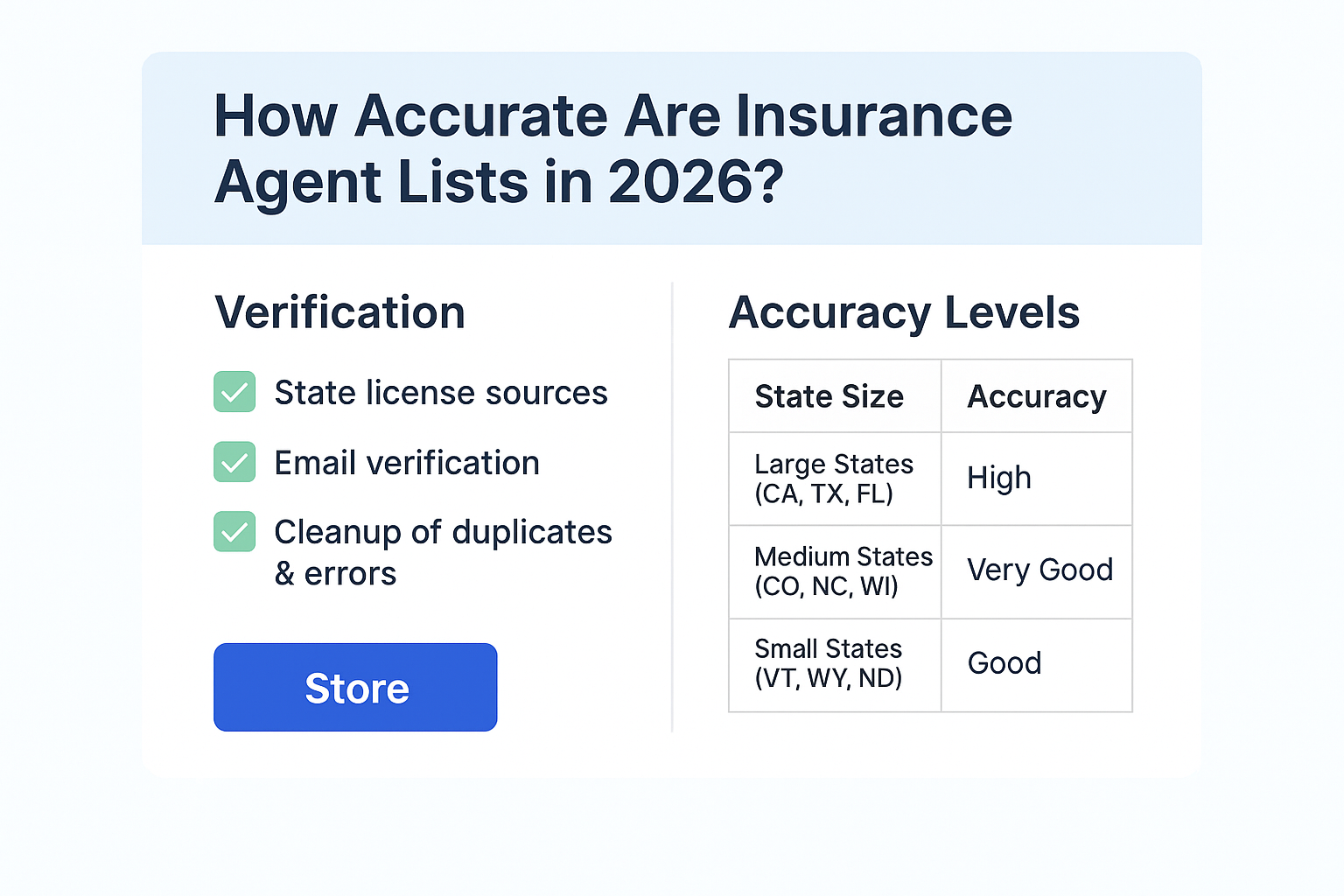

“Verified” gets used loosely in the list industry. For licensed insurance agents, verification should include:

- License-level validation against state or national registries at the time of assembly or recent refresh.

- Human QA to catch mismatched names, duplicates, and bad emails.

- Active channel checks (e.g., SMTP ping for email, dial-test or carrier signaling for phone).

- Recency controls (e.g., event-based updates after status changes or at defined refresh intervals).

For a deeper look at verification and data integrity standards, read: https://www.insuranceagentlists.com/what-does-accurate-data-really-mean-in-2026

Best Places to Buy Licensed Insurance Agent Lists by State

InsuranceAgentLists.com (fastest path to campaign-ready files)

If you need immediate coverage by state and line of business, start here:

- Life and Health by state: https://www.insuranceagentlists.com/store/Life-&-Health-Insurance-Agent-Lists-c140161591

- Property and Casualty by state: https://www.insuranceagentlists.com/store/Property-&-Casualty-Insurance-Agent-Lists-c140161592

- Full store overview: https://www.insuranceagentlists.com/store

- State counts before you buy: https://www.insuranceagentlists.com/state-counts

You can also purchase single-state files directly (examples):

- California P&C agents: https://www.insuranceagentlists.com/store/California-Property-&-Casualty-Insurance-Agent-List-p500481431

- New York P&C agents: https://www.insuranceagentlists.com/store/New-York-Property-&-Casualty-Insurance-Agent-List-p500481459

- Texas L&H agents: https://www.insuranceagentlists.com/store/Texas-Insurance-Agent-List-p235438840

This route is best when you want fast access, standardized fields, and deliverability-optimized emails to power outbound, recruiting, or partner development.

State insurance departments (official but manual)

State departments maintain license records. You can confirm statuses and sometimes export lists. This path is official but often slow and fragmented. Formats vary, contact channels may be limited, and exports can be raw or unstandardized. As reference points:

- Texas department page: https://www.insuranceagentlists.com/state-insurance-departments/Texas

- Florida department page: https://www.insuranceagentlists.com/state-insurance-departments/Florida

Use departments to validate edge cases, confirm licenses, or fill a niche coverage gap. For production-scale campaigns, plan extra time for data prep and enrichment.

Generic list brokers and marketplaces (buyer beware)

Some brokers resell scraped, outdated, or mixed-quality files. Delivery looks cheap. Total cost rises when you add bounce cleanup, deduping, and compliance risk. If you go this route, vet hard. This checklist will help: https://www.insuranceagentlists.com/how-to-choose-a-reliable-insurance-agent-list-provider-and-the-red-flags-to-avoid

Compare Your Options: Quality, Speed, and Total Cost

Below is a practical comparison of sources for state-level licensed agent data.

| Source | Licensing Verification | Update Frequency | Contact Channels | Typical Total Cost | Best For |

|---|---|---|---|---|---|

| InsuranceAgentLists.com | Verified against licensing data with QA | Rolling and scheduled refreshes | Email, phone, physical address; often firmographics | Moderate upfront, low cleanup | Fast campaigns, recruiting, multi-channel outreach |

| State Insurance Departments | Official licensing data | Varies by state, often periodic | Usually address; limited emails/phones | Low data fee, high internal labor | Compliance checks, one-off validation, niche pulls |

| Generic Brokers/Marketplaces | Mixed; often unclear | Irregular | Varies widely; risk of dead emails | Low sticker price, high hidden cost | Small tests if heavily vetted |

How to Choose the Right State List for Your Campaign

Start with the end in mind. Match the file to your goal and channel.

- Line of business

- Selling commercial lines? Start with P&C producers. Learn more: https://www.insuranceagentlists.com/Property-and-Casualty-Agents

- Selling final expense, Medicare, or life products? Start with L&H producers. Learn more: https://www.insuranceagentlists.com/Life-and-Health

- Geography and counts

- Confirm available records and coverage before you buy. Use state counts here: https://www.insuranceagentlists.com/state-counts

- Role and appointment mix

- Independent vs captive, principal vs producer, agency vs call center. Ask for the role or agency attributes that align with your pitch.

- Contact strategy

- If you plan an email-first sequence, ensure deliverability testing is built into the file. If you plan dials, confirm phone type (direct vs main line) and DNC compliance.

- Timeline and internal capacity

- If you have limited data ops resources, pick a standardized, ready-to-use file with clean headers, mapped fields, and de-duped records.

Real Scenarios: What to Buy and Why

Scenario 1: Medicare AEP recruiting in Texas

- Need: 2,500 L&H producers with recent Medicare activity, direct emails, and mobile phones.

- Buy: Texas L&H file with Medicare filter and active email flag.

- Why: Speed—AEP windows are tight. Start here: https://www.insuranceagentlists.com/store/Texas-Insurance-Agent-List-p235438840

Scenario 2: Commercial lines cross-sell in California

- Need: 3,000 P&C agents in CA focused on small business, with agency names and websites for research.

- Buy: California P&C agents with agency and website fields. Start here: https://www.insuranceagentlists.com/store/California-Property-&-Casualty-Insurance-Agent-List-p500481431

Scenario 3: MGA expansion into New York

- Need: 1,500 P&C producers with appetite for niche programs; prioritize independent agencies.

- Buy: New York P&C agents list filtered by agency type and title. Start here: https://www.insuranceagentlists.com/store/New-York-Property-&-Casualty-Insurance-Agent-List-p500481459

Data Fields You Should Expect in a Verified List

At a minimum:

- Full name, license number, license status, line of authority

- Agency name, title/role, business address

- Direct email (validated), phone (type flagged), website if available

- Optional: Appointment indicators, product focus, years active

See a detailed breakdown of common fields and deliverables here: https://www.insuranceagentlists.com/whats-included-in-an-insurance-agent-list-in-2026

Pricing Benchmarks and ROI: What to Budget

Pricing varies by depth of data, deliverability, and filters. As a rule of thumb:

- State L&H or P&C lists with validated email and phone cost more up front and return more per send due to higher reach and lower bounce waste.

- Department data may look inexpensive but usually requires enrichment and manual cleanup.

For a current market view, see: https://www.insuranceagentlists.com/how-much-do-insurance-agent-lists-cost-2026-price-comparison

What a Deliverability vs. Cost Chart Would Show

Imagine a two-axis chart:

- X-axis: Effective cost per usable contact (after bounce removal and deduping).

- Y-axis: Email deliverability rate (% inboxable emails after validation).

- Plot 1: InsuranceAgentLists.com — deliverability in the 90%+ range with moderate effective cost due to low cleanup.

- Plot 2: State department raw exports — deliverability data N/A unless you enrich; effective cost rises once you add enrichment and labor.

- Plot 3: Generic brokers — lower sticker price but variability in deliverability (60–85%); effective cost increases after revalidation and suppression.

Outreach Channels: Email, Social, and Phone—Done Right

Use the channels you can execute well and compliantly.

- Email marketing to licensed agents

- Use warmed domains, sequence messages, and suppression management. If you want done-for-you, see: https://www.insuranceagentlists.com/email-marketing

- LinkedIn outreach to producers and principals

- Use role-based filters and personalized notes. Learn more: https://www.insuranceagentlists.com/linkedin-marketing

- Voice outreach and voicemail drops

- Respect federal and state rules around automated dialing and voice messages. See overview: https://www.insuranceagentlists.com/voice-broadcast

Compliance and Best Practices

- License data usage

- Use lists for legitimate B2B outreach. Honor opt-outs and local regulations.

- Email rules

- Follow CAN-SPAM and state equivalents. Maintain clear unsubscribe links and prompt suppression.

- Phone rules

- Ensure DNC compliance and TCPA-safe dialing strategies. Classify phone types and avoid prohibited automated methods where applicable.

- Data governance

- Document your source, refresh date, and validation method. Maintain a feedback loop to correct bounces and bad numbers.

Choosing a Reliable Provider

Before you buy, review:

- Source transparency: Where does the license and contact data originate?

- Refresh schedule: How often are updates pushed?

- Validation process: How are emails and phones tested?

- Replacement policy: What happens if you find bounces or bad numbers?

- Samples: Can you test a file slice in your stack?

Use this full due-diligence checklist: https://www.insuranceagentlists.com/how-to-choose-a-reliable-insurance-agent-list-provider-and-the-red-flags-to-avoid

Need Lists Across Several States?

If you’re building regional coverage or launching nationally:

- Browse by category to assemble a multi-state file fast: https://www.insuranceagentlists.com/store

- Confirm volumes upfront: https://www.insuranceagentlists.com/state-counts

- If you need guidance on pulling any state’s agents directly, this overview will help: https://www.insuranceagentlists.com/how-to-find-licensed-insurance-agents-in-any-state-2026-guide

Quick Steps to Get Started Today

- Confirm your line of business and target roles.

- Check available counts by state: https://www.insuranceagentlists.com/state-counts

- Choose your product category:

- Request a sample if needed: https://www.insuranceagentlists.com/sample

- Plan your first 2–3 touch sequence using email, social, and phone. If you want help, review services:

Conclusion: Buy State-Verified Lists With Confidence

Buying licensed insurance agent lists by state should be simple, compliant, and effective. Start with verified data that maps to your offer and channel. Validate volumes, confirm refresh practices, and run a quick pilot to confirm performance in your stack. When you’re ready, browse our state lists and get campaign-ready files today:

- Store: https://www.insuranceagentlists.com/store

- State counts: https://www.insuranceagentlists.com/state-counts

- Contact our team: https://www.insuranceagentlists.com/contact

If you need a fast recommendation for your state and line of business, reach out. We’ll point you to the exact file and filters that match your goal.